What is the first step to buying a home for the first time?

For most people, as well as first time homebuyers, buying a home is the most significant investment they will make in their lifetime. It’s an exciting and sometimes nerve-wracking process, but if you do your homework and know what to expect, you can avoid many common pitfalls.

Remember that other costs are associated with buying a home beyond the purchase price, such as closing costs, moving costs, and repairs/updates that may need to be made. So be sure to factor those into your budget when determining how much house you can afford.

Click here to better help you understand the real estate terms you should know.

First-time home buyer requirements

Let’s dive deeper into what you need to do to meet the requirements.

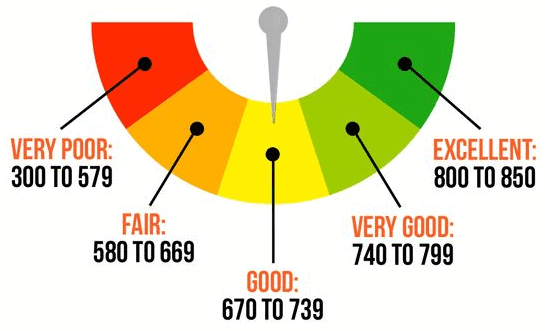

Finding out your credit score is the very first thing you must do. You will get your credit score from the big three of credit reporting. Equifax, Transunion, and Experian. These three reporting agencies will each give you a score that is added together and divided by three giving you your credit score.

The second step to buying a home for the first time is to figure out what you can afford. This means getting pre-approved for a mortgage to know how much house you can afford. Once you have that number, you can start shopping for homes in your price range.

Without a credit score and pre-approval letter, your real estate agent cannot help you.

What is the minimum credit score to buy a house?

Many factors go into your credit score, including payment history, outstanding debt, and credit utilization. The credit score is one of the most important factors when buying a house. Lenders will use your credit score to determine if you’re a good candidate for a loan and what interest rate they’ll offer you.

This number is determined by your credit history and indicates your likelihood of paying back a loan. The higher your score, the more likely you will be approved for a loan. Try this online mortgage calculator to understand how much you will pay.

So, what is the minimum credit score to buy a house? The minimum credit score to buy a home depends on the lender, but most lenders require a score of at least 600. If your credit score is lower, it doesn’t mean you can’t get a mortgage loan. If you’re unsure of your credit score, you can check it on a free website like Annual Credit Report.

How your credit score works

| Credit Scores | Requirements |

|---|---|

| 300-579 | Does not meet the minimum credit score requirements for FHA. |

| 580-699 | The borrower must come up with a 5-10% down payment. |

| 640-799 | A 3.5% down payment is required with compensating factors. |

| 740-799 | A 3.5% down payment is required. |

| 800-850 | A 3.5% down payment is required. |

Other Loan Options

VA Loans

If you’re a veteran looking for a home, you may wonder if a VA loan is the right financing option. VA loans offer several key benefits compared to other types of mortgages, including no down payment required and more flexible credit requirements.

VA loans are backed by the U.S. Department of Veterans Affairs and available through participating lenders, such as banks, credit unions, and mortgage companies. You can buy a home with no down payment or equity with a VA loan. The VA guarantees a portion of the loan, protecting the lender against loss if you default on the loan.

VA loans also come with more flexible credit requirements than other types of mortgages. While most lenders require a minimum credit score of 620, you may be able to qualify for a VA loan with a lower score.

USDA Loans

The USDA Loan is a government-backed loan that allows borrowers to finance a home with as little as 0% down. The loan is available to borrowers with moderate incomes looking to buy in rural areas. The USDA Loan offers many benefits, including no minimum credit score, low-interest rates, and flexible terms.

Additionally, the USDA Loan does not require a down payment, making it an attractive option for borrowers who may not have the savings for a traditional down payment. Who is eligible for a USDA Loan? To qualify for a USDA Loan, borrowers must have a credit score of 640 or higher. Additionally, borrowers must have a household income that does not exceed 115% of the median income in their area.

If you’re a farmer or rancher looking for financing to purchase farmland or agricultural property, you may be eligible for a loan through the U.S. Department of Agriculture (USDA). USDA loans are available through the Farm Service Agency (FSA) and come with several benefits, including low-interest rates and down payment requirements. To be eligible for a USDA loan, you must meet certain income and credit criteria.

What if my credit is bad, and how do I fix it? For Free!

Sometimes life can take unexpected twists and turns, causing your credit to suffer. Credit repair can seem daunting, but it doesn’t have to be expensive or complicated. Here are a few simple steps to start repairing your credit for free.

First, get a copy of your credit report from all three major credit bureaus. Review your reports carefully to identify any errors or negative items that may be dragging down your score.

Next, dispute any errors with the credit bureau in writing. Be sure to include supporting documentation to substantiate your claim.

Finally, start paying all of your bills on time, every time. This will help improve your payment history and boost your credit score.

Fix your credit for less than $20.

Get this comprehensive guide to boost your credit score. This guide will show how to correct discrepancies on your credit reports and what steps to take when the reporting agencies or creditors refuse to work with you.

What is the Best option for home financing

The first step to buying a home for the first time is often the most difficult- saving for a down payment. A down payment is an upfront, lump sum payment you make when you purchase a home.

The average down payment is 20% of the home’s value, which can seem like an impossible feat when you’re starting from scratch. Some programs allow for smaller or no down payments, they typically come with stricter requirements- like paying private mortgage insurance (PMI) every month.

Saving for a down payment can be difficult, especially if you are also trying to save for other things like an emergency fund or retirement. One way to help make it easier is to set up a budget and ensure that you automatically transfer a fixed amount of money into your savings account each month.

Another way to help come up with a down payment is to talk to your parents or other family members who may be able to help you out financially. They may not be able to give you the entire amount, but every little bit helps.

Here’s a further breakdown of the loan requirements.

Click to enlarge the image

FHA vs Conventional Loan

FHA loan is a mortgage insured by the Federal Housing Administration. It comes with more affordable down payment requirements and lower monthly payments.

Conventional loans are backed by loan officers at banks and credit unions. They come with different down payment and monthly payment options.

First time home buyer programs

As a first-time home buyer, you may be eligible for a tax credit of up to $15,000. There are several programs available to help you with the purchase of your first home. The First-Time Home Buyer Tax Credit is a federal program that provides a tax credit of up to $15,000 for first-time buyers. The program is designed to help with the costs associated with buying a home, such as closing costs and down payments. There are also state and local programs that offer assistance to first-time buyers.

These programs can provide down payment assistance, low-interest loans, and other forms of financial assistance. When you’re ready to buy your first home, research all the available programs to see which one can best help you reach your goals.

Go to “Down Payment Assistance Programs” (PDA) for a breakdown of programs by every state. Any information should be researched to ensure its accuracy.

First-time home buyers $7,500 government grant

Payment Assistance Programs

There are government first time homebuyer grants available to assist you in obtaining the American dream. The great thing about grants is you don’t have to pay them back. The grants may differ in certain areas, and the amount could also vary, so make sure you do some research. Here is an excellent article from bankrate.com showing you what kind of information is available and exactly where to look.

The government is offering a $7,500 grant for first-time home buyers. This payment assistance program is available to help people with their home’s down payment and closing costs.

This grant is an excellent opportunity for people looking to buy their first home. The government is committed to helping people achieve their dream of homeownership, and this grant is one way they do that.

If you are a first-time home buyer or know someone who is, take advantage of this program and apply for the grant today.

Best real estate agent for first-time home buyer

Your next step is to find a real estate agent. A real estate agent can help you find the best home for your needs, discuss how much house you should aim for, and guide you in the search and negotiations for your home. The real estate agent cannot help without you obtaining a credit score and pre-approval.

When is the best time to buy?

Finding a home in today’s real estate market can be highly challenging. Finding a home that suits your needs and is within your budget can be even more difficult. Fortunately, there are ways you can make this process easier on yourself. Use these tips to help you make the process of buying a home a little less complicated.

- Get pre-approved

- Find a real estate agent you trust to help you navigate the process

- Be patient and don’t panic because things are super competitive right now

- Have money ready for downpayment and closing

- Make a strong offer when you find a home

First-time home buyer mistakes

For first time home buyers, the process can be overwhelming and full of potential mistakes. By being aware of the most common mistakes, buyers can avoid them and make the process smoother.

One frequent error is not getting a pre-approval for a mortgage before starting to look at homes. This can lead to disappointment when you find the perfect home but cannot secure financing. Another misstep is underestimating the costs associated with homeownership, such as maintenance, repairs, and property taxes.

First time homebuyers also need to be mindful of hidden costs, such as title insurance and closing costs. These can add up quickly and eat into your budget for other essentials, like furniture or appliances. Finally, don’t forget the importance of getting homeowner’s insurance to protect your investment.

When are you considered a first-time home buyer again?

If you’re a first-time homebuyer who used the program to purchase your home, you may wonder if you can use it again to buy your second home. The answer is maybe. It depends on the rules of the specific program you used and whether or not you still meet the eligibility requirements.

For example, if you used a government-sponsored program like FHA, VA, or USDA, you may be able to use the program again as long as you still meet the eligibility requirements. However, if you use a program offered by a private lender, they may have different rules and restrictions.

So, if you’re considering using the first-time homebuyer program to purchase your second home, check with the specific program guidelines to see if you’re eligible.

Things to consider when renting or owning

| RENT | OWN |

|---|---|

| Will never own | Homeownership |

| Rent increases during inflation | Payment doesn’t change during inflation |

| Build equity for your landlord | Build equity for yourself |

| No leverage | Leverage |

| No tax advantages | Tax advantages |

| Can be evicted for several reasons | Stability |

| No Control | Control |

There are a lot of things to think about when you’re trying to decide if you should rent or own your next home. As a first time home buyer, it’s essential to research and ask yourself some critical questions before making such a big decision. Here are a few things to consider when deciding if you should rent or own your next home:

Can you afford the monthly payments? When owning a home, you’re responsible for mortgage payments, property taxes, insurance, and repairs. Make sure you can comfortably afford these monthly expenses before leaping into homeownership.

Do you plan on staying in one place for a while? If you’re unsure how long you’ll live in one place, renting might be the better option. Try this rent or buy calculator to help you decide.